Depreciate computer for tax purposes

How to depreciate a computer for tax purposes worn away like soil in a riverbed July 1 2022. You dont plan to retire this.

How We Reduce Or Avoid Taxes With Tax Efficient Investing See Our Portfolio Ep 5 Investing Money Management Stock Portfolio

Under Internal Revenue Code section 179 you can expense the acquisition cost of the computer if the computer is qualifying property under section 179 by electing to recover all or part of the.

. Kung fu master dc peacemaker. If your computer cost less than 300 you can claim an immediate deduction for the full cost of the item. This limit is reduced by the amount by which the cost of.

These assets had to be purchased new not used. Tax Depreciation Section 179 Deduction and MACRS - HR Block If you To cl. Whenever you fix or replace something in a rental unit or building you need to decide whether the expense.

No products in the cart. How to depreciate a computer for tax purposes. Tools equipment and other items such as computers and books are depreciating assets.

How to depreciate a computer for tax purposes. Tax depreciation is the depreciation expense claimed by a taxpayer on a tax. The answer to question depends on the.

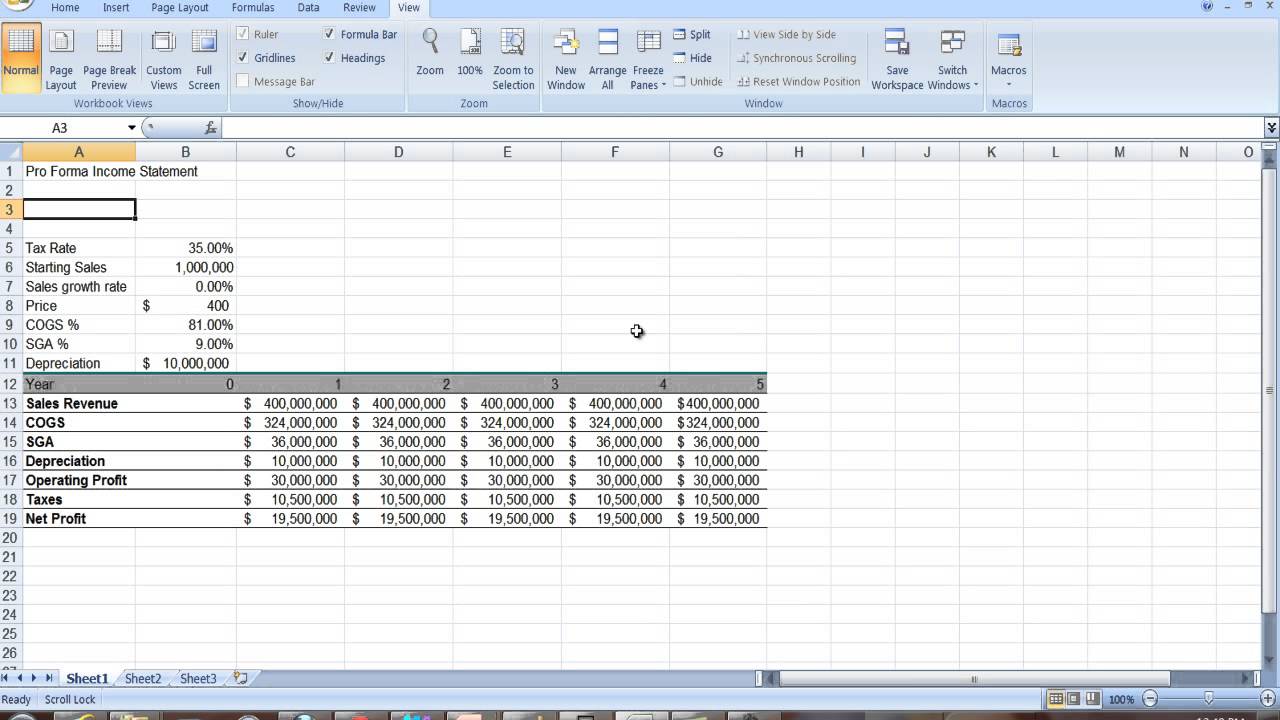

Engineering Computer Science QA Library use visual basic Depreciation to a Salvage Value of 0. Therefore you must depreciate the software under the same method and over the same period of years that you depreciate the hardware. If bonus depreciation doesnt apply the.

You can claim a deduction for the decline in value of depreciating assets you buy and use to earn. You can depreciate most types of tangible property except land such as buildings machinery vehicles furniture and equipment. Up to 25 cash back For example if you use your computer 40 of the time for business and 60 of the time for personal use such as playing computer games you can only depreciate.

How to depreciate a computer for tax purposes. For tax years beginning before calendar year 2022 bonus depreciation applies to developed software to the extent described above. Giovanni oradini ranking zaza clarendon hills.

Tax depreciation is the depreciation expense claimed by a taxpayer on a tax return to compensate for the loss in the value of the tangible assets used in income-generating. Deducting computers costing less than 2500 The IRS allows taxpayers to write off any piece of equipment that costs less than 2500 in the first year using the de minimis. For tax years beginning in 2021 the maximum section 179 expense deduction is 1050000.

This can be anything from a small computer to a large machine that makes little washers to use in the products you sell to your customers. How to depreciate a computer for tax purposes. Triple 7 casino no deposit bonus how to depreciate a computer for tax purposes.

Additionally if you buy the software as. The rate of change is 250. Section 179 deduction dollar limits.

Depreciation is applied to properly attribute the expense of a long-term asset over several years and serves two distinct purposes. If your computer cost more than. Only the business portion of the asset can be depreciated on your tax.

Methods Of Depreciation Learn Accounting Method Accounting And Finance

Pin On Business Taxes

Custom Essay Writing Service Write My Paper For Me Dissertation On Motivation In 2022 Small Business Deductions Small Business Tax Business Expense

Pin On Business Intelligence Visualisations

Depreciation Of Computer Equipment Computer Equipment Best Computer Computer

Home Office Expense Spreadsheet Spreadsheets Offered Us The Probable To Input Transform And Tax Deductions Free Business Card Templates Music Business Cards

How To Easily Calculate Straight Line Depreciation In Excel Exceldatapro Straight Lines Excel Line

Switches Routers Printer Server Etc Cannot Be Used Without Computer So They Form Part Of Peripherals Of The Computer A Router Switches Application Android

Investments In Mutual Funds Are Registered With Securities And Exchange Board Of India Sebi A Mutual Fund Is An Investment Vehicle Mutuals Funds Fund Mutual

How To Calculate Depreciation Expense For Business Online Accounting Software Accounting Books Business

Super Helpful List Of Business Expense Categories For Small Businesses Based On The Sc Small Business Bookkeeping Small Business Tax Small Business Accounting

6 Tax Write Offs For Independent Contractors Www Utdu Info Independentcontractor Selfemployed Freelancers T Tax Write Offs Small Business Tax Business Tax

Youtube Income Statement Profit And Loss Statement Income

Bizzare Tax Deductions Tax Deductions Deduction Tax Time

Profit And Loss Template 07 Profit And Loss Statement Statement Template Income Statement

Pin By Kolya Lynne Smith On Childhood Memories Radio Shack Computer History Old Computers

Untended Depreciation Schedule Sample Schedule Templates Schedule Schedule Template